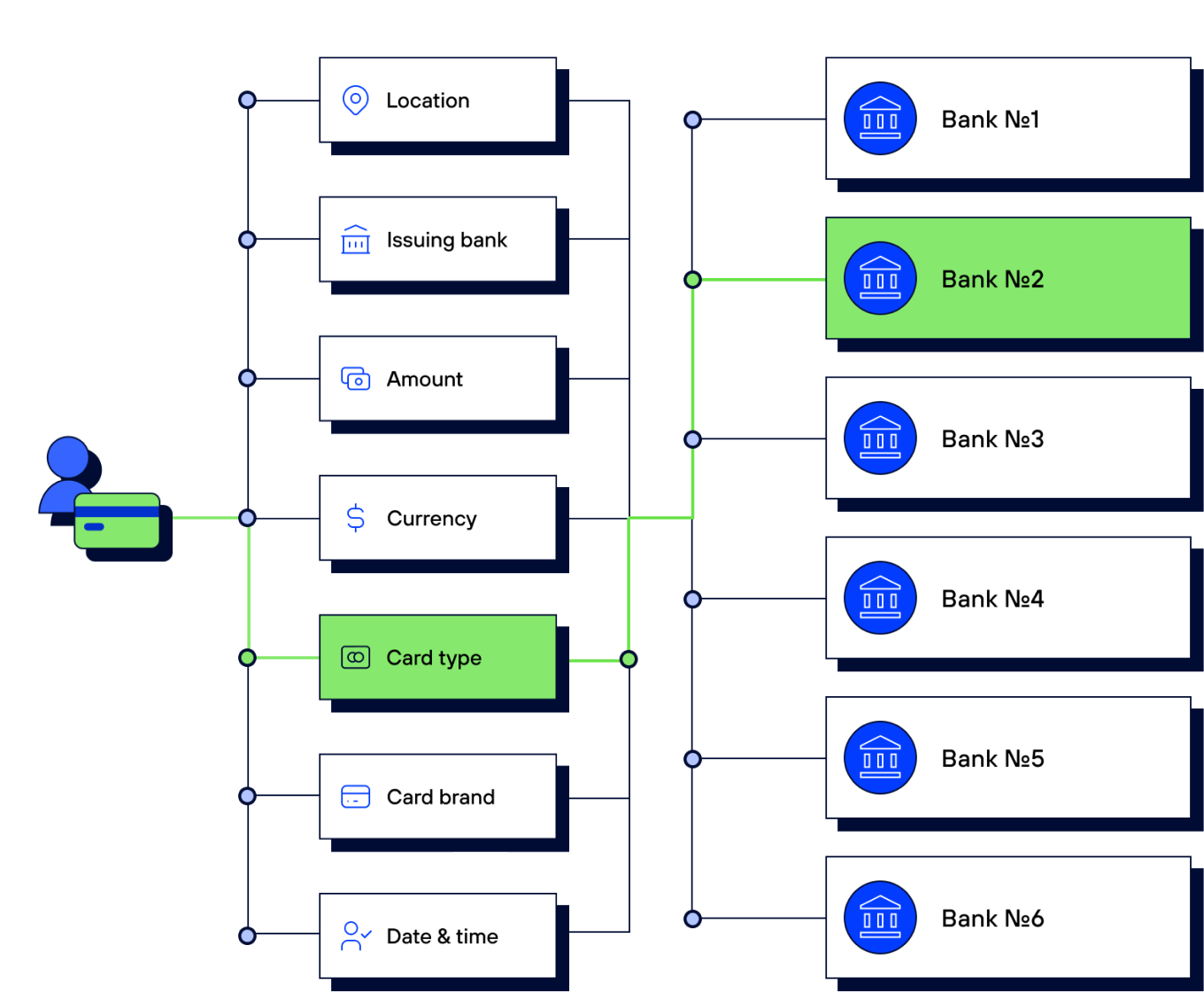

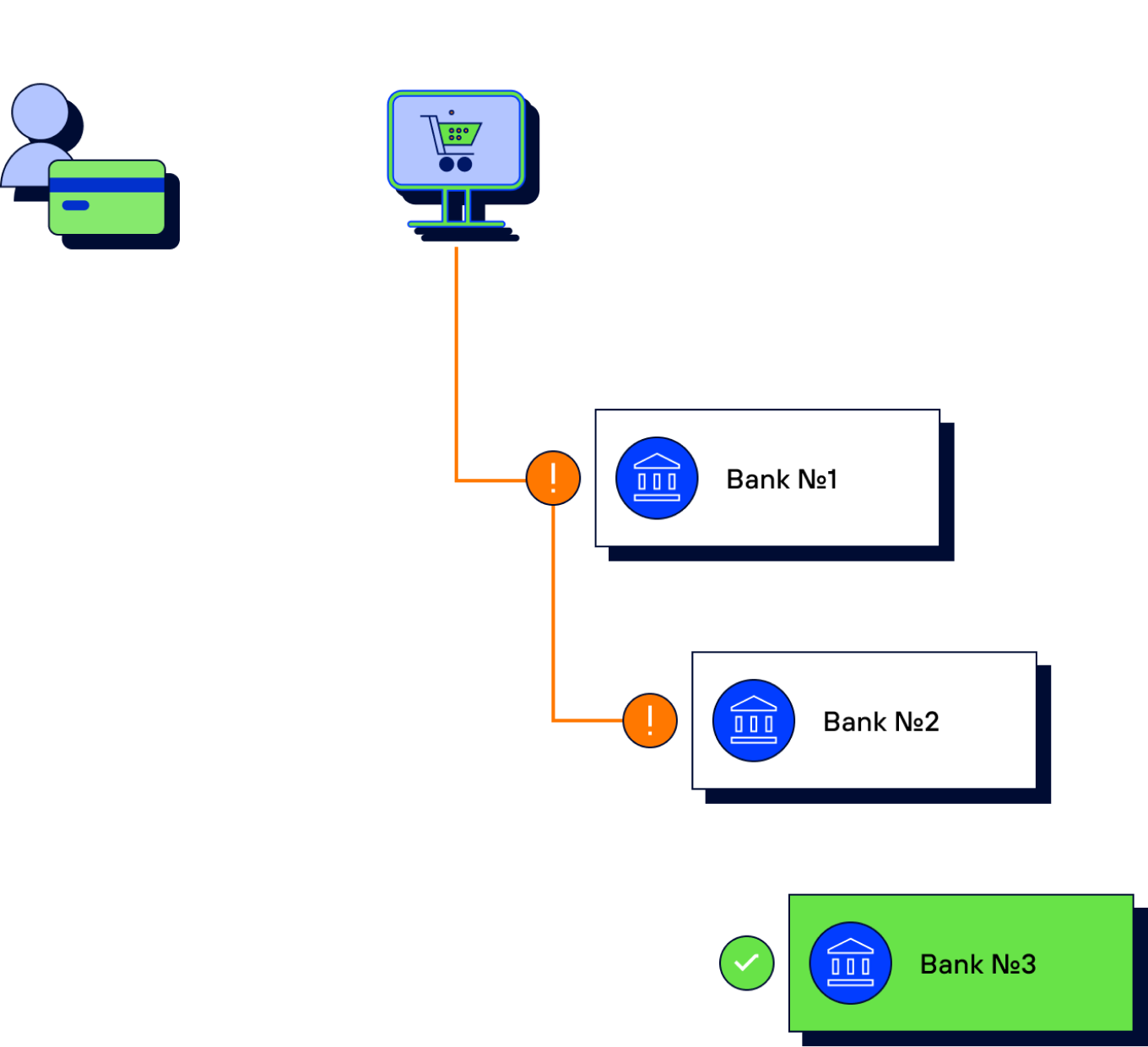

It helps not only to increase conversion rate but also to lower transaction fees.

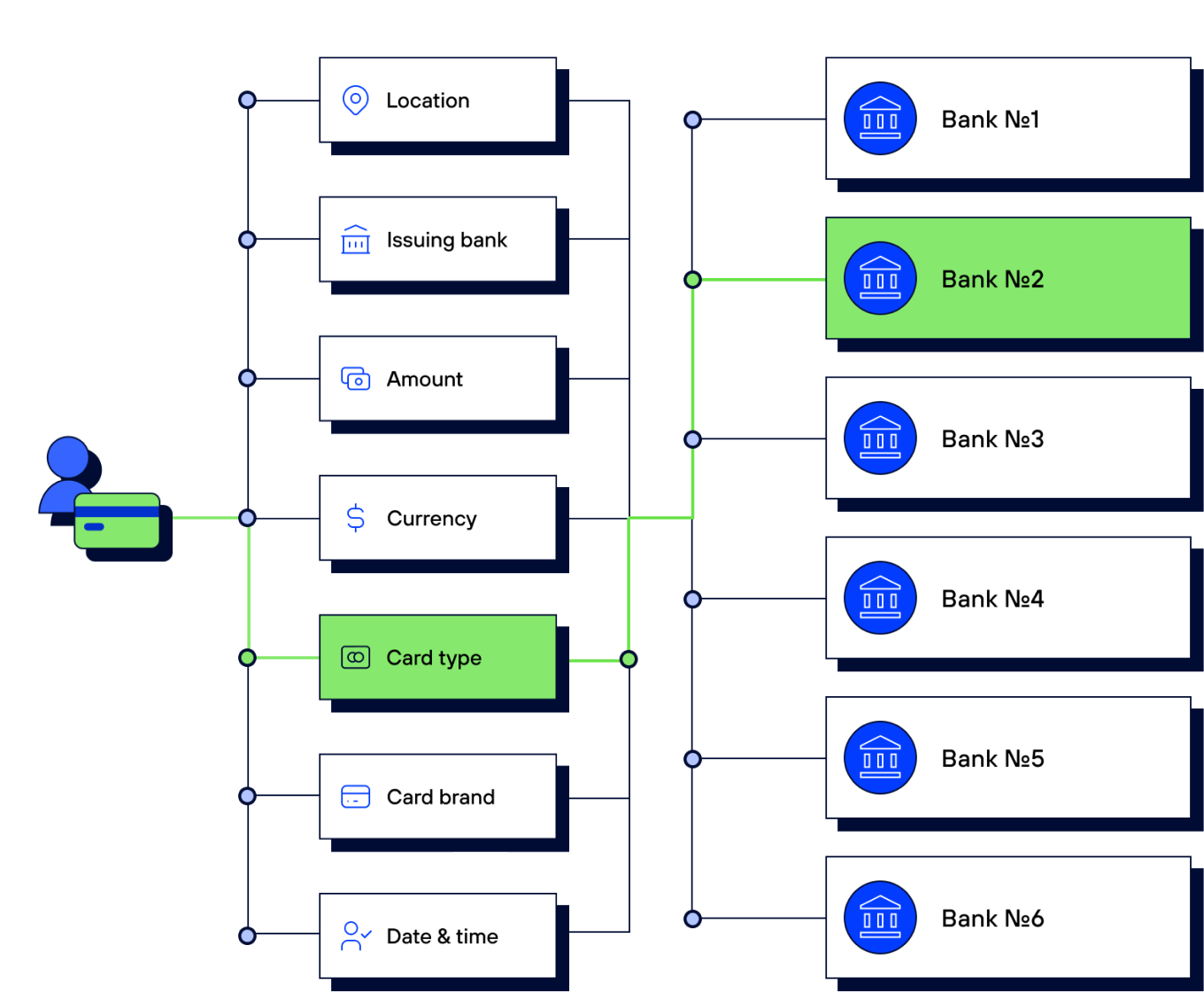

Allocate payments between different acquirers based on the region of operation, currency, payment method and other criteria.

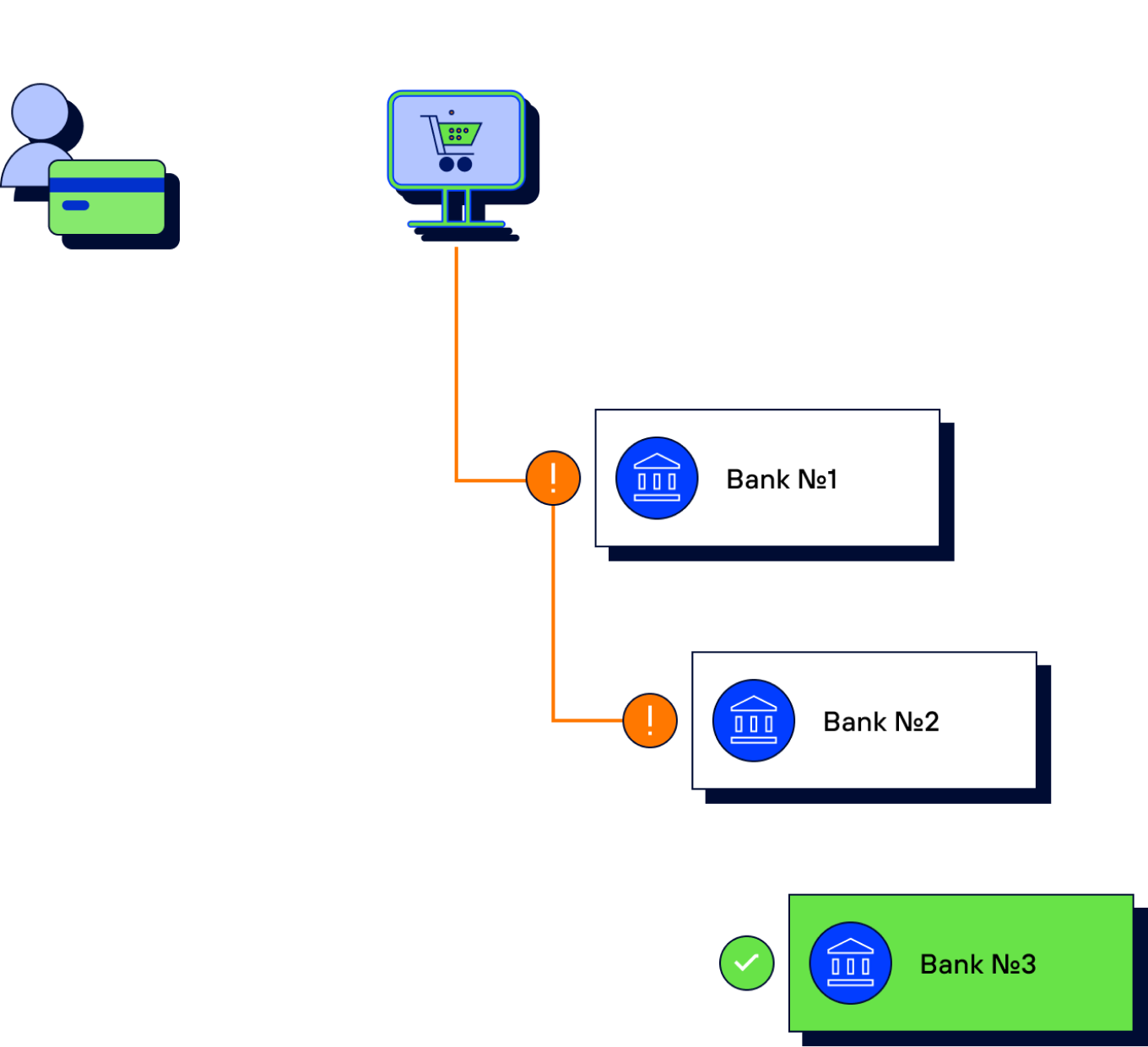

This feature increases the chance that transactions will be approved, thus improving the success rate of payments.

If the main bank is unable to process the payment, it is automatically redirected to an alternative payment channel.

Agile microservice infrastructure complemented by Google Cloud services ensures the uninterrupted performance of the system and provides a high level of security.